Can You Accept Your Awards Again in Spring Semester

How Much Student Loan Tin can I Borrow Per Semester

My Student Loan Debt Journey From Physical Therapy School | Debt Complimentary Journey

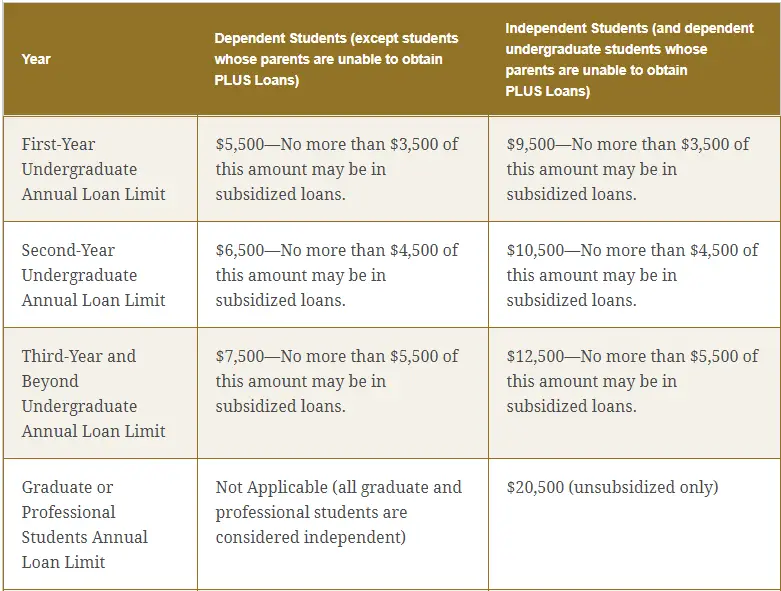

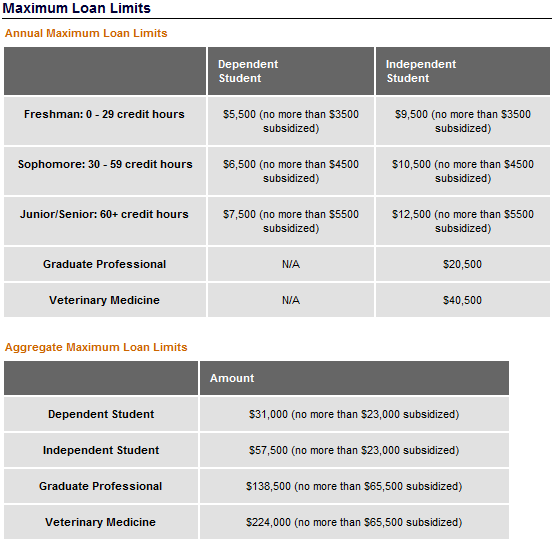

Undergraduates can infringe upward to $12,500 annually and $57,500 full in federal student loans. Graduate students can borrow up to $20,500 annually and $138,500 total.

Direct subsidized and unsubsidized loan limits.

| Dependent undergraduate students |

|---|

| $20,500 |

How long does it take to pay off a educatee loan?

- Federal student loan providers estimate that it will take borrowers 10 years to pay off their student loans, or at to the lowest degree thats the timeline for payoff with a standard repayment plan.

How Much Should Y'all Borrow

The depression borrowing limits and interest rates on the most affordable federal loans for undergrads mean that well-nigh borrowers who cease their degrees tin repay them.

But if you lot get on to grad schoolhouse, its easier to take on the level of educatee loan debt thats more difficult to repay. The higher limits on PLUS loans can saddle you lot with six-figure loan debt.

You tin utilise the Department of Educations College Scorecard to become an thought of how much debt its reasonable to take on with the degree you are pursuing.

Tip:

Federal Sources Of Fiscal Aid Per Year

Federal fiscal aid programs are provided through the U.Due south. Department of Education . Congress votes on how much money each programme receives every year, and what the minimum and maximum amounts of financial support can be.

This grant has specific rules near working in certain fields and following certain classwork paths to go a certified teacher upon graduation. If you do not encounter these standards, your grant will be revoked, and you may have to pay some or all of it dorsum.

- Educatee loans : There are several loan programs provided past the federal regime, including:

- Direct subsidized loans

- Direct PLUS loans, both for graduate students and parents with dependent undergraduates

- Directly consolidation loans

Loan amounts vary based on several factors, like:

- Whether y'all are a dependent or contained undergraduate educatee

- Whether y'all are a graduate or professional person educatee

- Whether you take defaulted on student loan payments in the past

- Whether you have a significant financial need, qualifying you for subsidized loans

How much you can have out also depends on your academic yr in school. Here are the current amounts ready by the federal regime:

You may too qualify for the federal piece of work-report program, which helps yous discover a job, either on or off-campus, and pays y'all upfront and so you can use the income to your instruction costs. The corporeality you receive through this plan varies by school.

Recommended Reading: Usaa Motorcar Loan Rates Credit Score

What To Do If You Achieve Your Borrowing Limit

If youve gone over your allotted amount of federal loans, at that place are a few things you lot tin can do to be in skilful standing once again.

You tin:

Repay Your Loans or Make Payment ArrangementsYou lot can contact the National Student Loan Data System to find out which loans are over your limit and how much you need to repay to regain eligibility for loan borrowing. We will need a proof of payment and an adjusted loan history after youve made a payment to proceed to award federal assistance to you lot. Information virtually this is also available on your Student Aid Study and from FAFSA.

Consolidate Your Loans: Yous tin can contact the servicer for your loans to find out how to consolidate them. We will need to run into the proof of your consolidation arrangement before we can keep to award federal help to yous.

Sign a Reaffirmation Letter of the alphabet: You can sign an agreement, or reaffirmation letter, that acknowledges the debt and affirms your intention to repay the excess corporeality every bit role of the normal repayment procedure. Yous can contact your federal loan servicer straight to get a letter.

To observe out who your servicer is, yous can contact the National Student Loan Data System or the U.S. Department of Education at 1-800-433-3243.

Direct Loans: Subsidized And Unsubsidized

Both subsidized and unsubsidized loans are granted at the beginning of a semester, and neither is required to exist paid dorsum until later you graduate . No matter which yr the loan covers, once youre out of school, your payments brainstorm.

The big difference between subsidized and unsubsidized loans is when you first paying interest.

An unsubsidized loan gains interest just like a individual loan would: starting the day you accept it out. The dont-pay-until-you-graduate grace menstruation only applies for your loan payments. Interest payments are still required throughout your time in schoolhouse.

Notwithstanding, if you take out a subsidized loan, the government pays interest for yous while youre in school. Your personal interest payments will begin but after you graduate, forth with the rest of your loan payments.

If youre going to have out a federal pupil loan, Rebecca recommends pursuing a subsidized one.

I call back the difference by saying unsubsidized is uncool, Rebecca said. Paying off the interest on an unsubsidized loan tin be very stressful for students, especially if they arent earning much on the side while theyre in school.

Plus, she mentioned, if yous are earning an income while in school, you would be better served by putting that money toward paying for your next semester upfront and skipping the loans birthday rather than paying downward a growing debt.

The fewer loans you take out, the less involvement you pay. The less interest you pay, the cheaper college will exist.

Don't Miss: What Credit Score Is Needed For Usaa Auto Loan

Federal Borrowing Limits For Graduate Students

| $138,500 | $65,500 |

Your federal borrowing limits are higher if youre working on a masters or doctorate plan, including an Yard.A., MBA, M.D., J.D., or Ph.D.

The annual borrowing limit for grad students is $xx,500 a twelvemonth, and y'all can borrow upward to $138,500 in full, including the loans y'all took out as an undergraduate. Since July i, 2012, grad students arent eligible to take out subsidized loans anymore. But its possible for grad students who took them out before then to take up to $65,500 in subsidized loans.

Medical school students can have out up to $224,000 in federal loans before turning to grad PLUS or individual student loans. For most medical schoolhouse students, the annual borrowing limit on the more affordable federal student loans is $40,500.

Acquire More: Graduate Student Loan Limits: How Much Can You lot Get?

Subsidized And Unsubsidized Loan Examples

Example 1:

Alberta Gator is a starting time yr dependent undergraduate pupil. Her cost of attendance for Autumn and Leap terms is $17,600. Albertas expected family unit contribution is $ten,000 and her other financial assistance totals $9,000.

Because Albertas EFC and other fiscal Aid exceed her Toll of Attendance, she is not eligible for need-based, Subsidized Loans. She is, however, eligible for an Unsubsidized Loan. The amount she would be awarded would be $five,500. Even though her cost of attendance minus other financial aid is $8,600, she tin can only receive up to her almanac loan maximum .

Read As well: What Credit Score Is Needed For Usaa Auto Loan

Individual Educatee Loan Process

To apply for a private loan you dont demand to file a FAFSA. Youll need to employ for a loan with an private lender. The lender will bank check your credit score and volition often require a creditworthy cosigner.

If you take decided a private loan is correct for you, cheque out our list of the best private student loans to compare lenders.

Turns Out There Are A Few Differences Between A Federal Pupil Loan And A Private Loan:

How Much Tin You lot Have Out In Student Loans Per Semester?

-

Most federal loans dont crave a credit check.

-

Federal loans often have low, fixed interest rates,which vary based on the first disbursement date of the loan. The involvement rate for Direct Subsidized Loans, Direct Unsubsidized Loans, and Directly PLUS Loans for undergraduate borrowers first disbursed on or afterwards July 1, 2020, and before July i, 2021, is ii.75%

-

Federal loans are tax-deductible.

-

Federal loans can as well be deferredmost normally, students volition defer their loans for upwardly to 6 months after they graduate .

-

Lastly, federal loans are eligible for loan forgiveness in some special cases.

While this list may brand federal student loans wait nicer than what Mr. Local Broker Human being would has to offer, it should be noted that student loans are still debt. Taking out a student loan means spending coin you dont accept and that you will have to pay back… with interest.

Taking out a multi-thousand dollar loan at 18, with no career or fifty-fifty the guarantee of a expert job once you lot graduate? Thats a financial gamble. For better or worse, it volition bear on your life long after higher.

Given that, lets talk near the dissimilar kinds of federal student loans you could employ for and the bear upon they tin take on your fiscal futurity.

Recommended Reading: How To Find Pupil Loan Number

What Is Financial Assistance

Most students dont have the ability to pay for college out of pocket. Because tuition, books, room and board, and other related fees, the cost tin can exist substantial. Not surprisingly, most students need to inquiry financial help options.

Fiscal help consists of a variety of components that help students pay for college, such as scholarships, grants, loans, and work-written report programs. Although some types of assistance do not need to be paid back, others do.

Information technology wasnt until I talked to Rebecca that I learned that financial aid does not always equate to complimentary money.

Its absolutely possible to qualify for grants, which are substantially gratuitous money, Rebecca said, merely virtually of the time, accepting financial assist means taking out federal loans.

I suddenly felt ripped off. No oneNO ONEever told me that fiscal aid meantstudent loans. Having been raised to alive debt gratis myself, the idea that pupil debt may be masquerading under a friendlier title didnt sit well with me.

If financial aid is just a loan, I asked, how is it whatsoever better than getting a individual loan to pay for college?

When Should I Apply For Student Loans

In social club to apply for federal pupil loans, y'all must fill out your FAFSA during a specific time. The federal deadline for completing your FAFSA usually comes very late in the school yr. For example, the deadline for the 2021-2022 school year is xi:59 pm on June 30, 2022. However, the federal borderline shouldnt be your only focus.

Schools have FAFSA deadlines as well, varying from campus to campus. Make a annotation to contact your schools financial aid office if youre unsure when y'all need to have your FAFSA completed. Nonetheless, as a general rule, yous should plan on applying for federal student loans before the starting time of the semester.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

How To Get The Nigh Financial Aid Per Semester

Federal fiscal aid is calculated a picayune differently by each school, only they all use your FAFSA number to determine your specific fiscal need. You should always provide accurate and truthful information on your FAFSA. Lying most income or moving money around can cause you lot to lose your award and be barred from receiving federal financial aid for the rest of your instruction. There are several ways to get enough fiscal aid to cover the cost of your post-secondary education, either from the federal government, your state authorities, and/or your school.

- Notice merit-based scholarships to utilize for, both through your college and from nonprofits or for-profits.

- Complete your FAFSA information early since some coin is offset-come, offset served.

- Inquiry other sources of income, like private student loans.

Need-based aid and federal educatee loans are the major sources of monetary support for students all over the U.s.a., but they are not the just options to assistance you get through school. You lot could qualify for country-based grants and scholarships, which too use the FAFSA to determine your eligibility. Hobbies, good grades, and many other skills can help you lot authorize for merit-based scholarships through your higher or from businesses outside your establishment.

Federal Direct Plus Loan

Grad PLUS and Parent PLUS loans are bachelor to graduate students and parents of dependent undergraduate students. PLUS loans arent subsidized, so interest will start accruing as soon as the loan is fully disbursed. Repayment can be deferred while the student is enrolled in college and for six months after graduation.

Recommended Reading: What Credit Score Is Needed For Usaa Car Loan

Is Information technology Worth Information technology

If the estimated payments will crusade a financial strain, the family unit has to consider its options. The pupil may want to attend a lower-price community higher to consummate their lower-division or general pedagogy requirements and so transfer to a university, or attend some other college completely. The family tin can also pull together to earn additional money, or the educatee can intensify the search for scholarships to locate additional funding.

Pupil Loan Rates Are Ascent

Employ for a private student loan and lock in your rate before rates become any higher.

This chart from the Pennsylvania State Academy student aid role breaks downwardly the limits depending on your situation:

| Dependent Undergraduate Educatee | Dependent Undergraduate Student with a Parent PLUS Loan Denial | Contained Undergraduate Student | Graduate or Professional Degree Student | |

|---|---|---|---|---|

| Starting time Year | $five,500. A maximum of $3,500 may be subsidized. | $nine,500. A maximum of $3,500 may be subsidized. | $9,500. A maximum of $iii,500 may be subsidized. | $20,500 |

| $6,500. A maximum of $4,500 may be subsidized. | $10,500. A maximum of $4,500 may be subsidized. | $10,500. A maximum of $4,500 may be subsidized. | $20,500 | |

| Third, Fourth, and Fifth Years | $7,500. A maximum of $5,500 may exist subsidized. | $12,500. A maximum of $5,500 may be subsidized. | $12,500. A maximum of $5,500 may exist subsidized. | $twenty,500 |

| $31,000. A maximum of $23,000 may be subsidized. | $57,500. A maximum of $23,000 may be subsidized. | $57,500. A maximum of $23,000 may exist subsidized. | $138,500. The graduate debt limit includes Direct Loans received for undergraduate written report. |

Besides these student loan limits, there are two other limitations to be enlightened of:

As well Check: Usaa Classic Auto Loan

Attention School Less Than One-half Time Y'all Can However Utilize For A Pupil Loan

Whether youre a total time, half-time, or less than half-fourth dimension student, you tin can utilize schoolhouse loans to pay for all your schoolhouse-certified expenses at degree-granting institution.Taking winter or summer classes? Studying away? Taking continuing education or professional person certification courses? We have student loans that tin can help you pay for classes taken online, on campus, or anywhere.

Accept And Receive Your Federal Direct Loans

How I Prepare for the Semester | tips, schedule, organization

Temple Academy students must accept offered Federal Straight loans online in the Financial Assist section of Self-Service Banner in the TUportal later on receiving email notification that the financial assistance accolade is ready for review.

New Federal Direct loan borrowers must complete a Main Promissory Note and Entrance Interview.

You May Like: Genisys Loan Computer

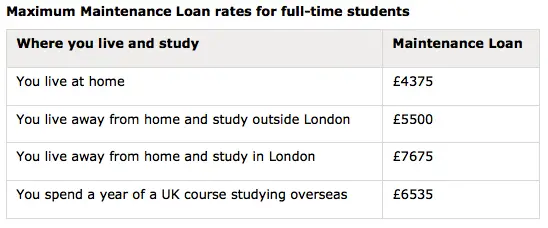

Maintenance Loan For Living Costs

You may have to requite details of your household income – this can impact how much yous get.

The loan is paid direct into your bank account at the kickoff of each term. You take to pay the loan back.

| 2020 to 2021 academic twelvemonth | 2021 to 2022 academic year | |

|---|---|---|

| Living at home | ||

| Living away from home, outside London | Upwards to £9,203 | |

| Living abroad from home, in London | Up to £12,010 | |

| You spend a year of a UK grade studying abroad | Up to £10,539 | Upwardly to £x,866 |

You may not get the full amount, then you may have to find other means to fund the rest of your living costs. This could include, for example, function-time work, local potency assistance, bursaries, scholarships, or family contributions.

You lot can apply the pupil finance reckoner to gauge how much Maintenance Loan youll become – it volition too tell you if youre eligible for extra grants or allowances.

If youre lx or over on the kickoff 24-hour interval of the first academic year of your grade you can utilise for up to £4,014.

You must report whatsoever changes to your living arrangements in your online account, and then you get the correct amount of student finance. Y'all might need evidence of any changes.

How Tin can I Pay For College Without Loans

And so if youre feeling anxious about the all-time means to pay for college without student loans, lets look at the options. Pay Cash for Your Degree. Apply for Assistance. Choose an Affordable School. Go to Customs College Get-go. Consider Directional Schools. Explore Trade Schools. Apply for Scholarships. Go Grants.

Likewise Bank check: What Credit Score Is Needed For Usaa Auto Loan

Cull More Affordable Options

If youve maximized your scholarship and grant potential and dont qualify for work-study, consider more affordable options. Some pocket-sized changes include opting to hire or buy used textbooks instead of new, living off campus or getting roommates. You lot can also consider transferring to an in-state school, trying out an online plan or dropping to half-time enrollment while you piece of work a part-time job.

Loan Proration For Graduating Undergraduate Students

If you are a graduating senior and but attending ane semester, your Federal Direct loans may be prorated based on the number of credits for which you are enrolled. This means that yous may not be eligible to receive your maximum annual loan limit.

This affects students enrolled for only one final semester in an academic year: either autumn-only, jump-only, or summer-only. For example, this will non affect students who are enrolled in fall and leap semesters and graduate at the end of the spring semester.

You lot May Similar: Loans Without Proof Of Income

Source: https://www.understandloans.net/how-much-student-loan-can-i-get-per-semester/

0 Response to "Can You Accept Your Awards Again in Spring Semester"

Post a Comment